Temu will open its marketplace to U.S. sellers in March and extend to European sellers soon after. The number one most-downloaded shopping app is expanding beyond Chinese sellers.

The more than 100,000 sellers on Temu today are all based in China, based on Marketplace Pulse research. Because Temu’s marketplace requires sellers to agree on wholesale pricing and ship goods in bulk to Temu’s warehouses in China. Temu then handles listing, marketing, fulfillment, customer service, and pricing. The marketplace is thus closer to the consignment model or can also be called a fully-managed marketplace.

According to reports in China, on March 15th, Temu will expand its marketplace to allow U.S. and, later, European sellers. Unlike Temu’s existing Chinese sellers, they will not ship goods to Temu’s warehouses in China and instead handle fulfillment from their domestic warehouses. Temu will also not manage pricing or marketing, thus effectively mimicking the Amazon, eBay, and Walmart marketplaces.

While the change removes the technical and operational hurdles for U.S. sellers to join Temu, it will face the same uphill battle as its predecessors did when trying to grow beyond Chinese sellers. Wish, AliExpress and other marketplaces built on supply from China have tried similar strategies to diversify their seller base. However, they were largely unsuccessful in both attracting a significant number of domestic sellers and repositioning themselves in the eyes of consumers.

Most recently, Shein was reaching out to Amazon sellers in 2023 with messages like “With how successful [Brand Name] has been on Amazon, I am reaching out to you today with the opportunity to bring [Brand Name] to SHEIN Marketplace.” But few have joined since. One seller who received the Shein invitation said, “We got the same message. I marked it as spam.”

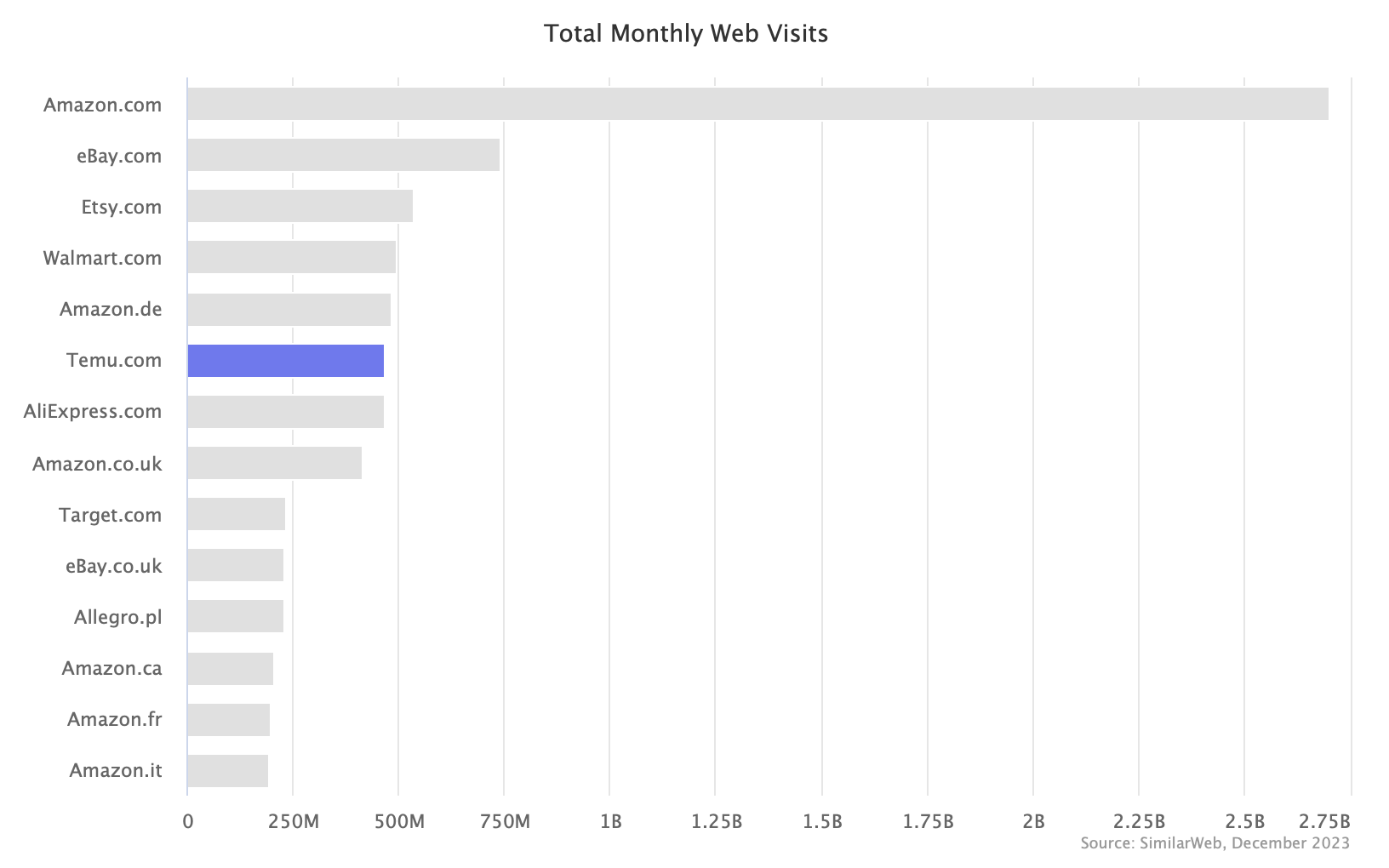

In terms of web traffic, by the end of 2023, Temu was as frequently visited as Walmart. Each with nearly 500 million visitors a month, based on SimilarWeb data. Over the past few years, Walmart’s marketplace has accelerated both in GMV and the universe of sellers - it now counts over 100,000 active sellers. Temu’s promise to sellers will be that the opportunity is just as great and initially less competitive. Perhaps even bigger if Temu’s marketing spending continues.

It’s unlikely that Temu will be able to attract established brands. In China, Temu’s parent company, PDD, eventually grew beyond its original selection to become one of the biggest sales channels for brands like Apple. Temu is far away from that. Instead, Amazon’s Chinese sellers will join first; it has hundreds of thousands of them. Their assortment is similar to what’s selling on Temu already (they are likely selling on Temu themselves), and their inventory stored in FBA warehouses will enable fast shipping on Temu.

Adding quick delivery, an option absent on Temu today, is why Temu is evolving past a fully managed marketplace. Sellers with domestic warehouses are the lever to get that. The change is less about expanding beyond Chinese sellers to U.S. sellers and more about evolving past shipping each package from China. Temu sells to 40+ countries from one source; it wants to add just as many countries as sources of goods.